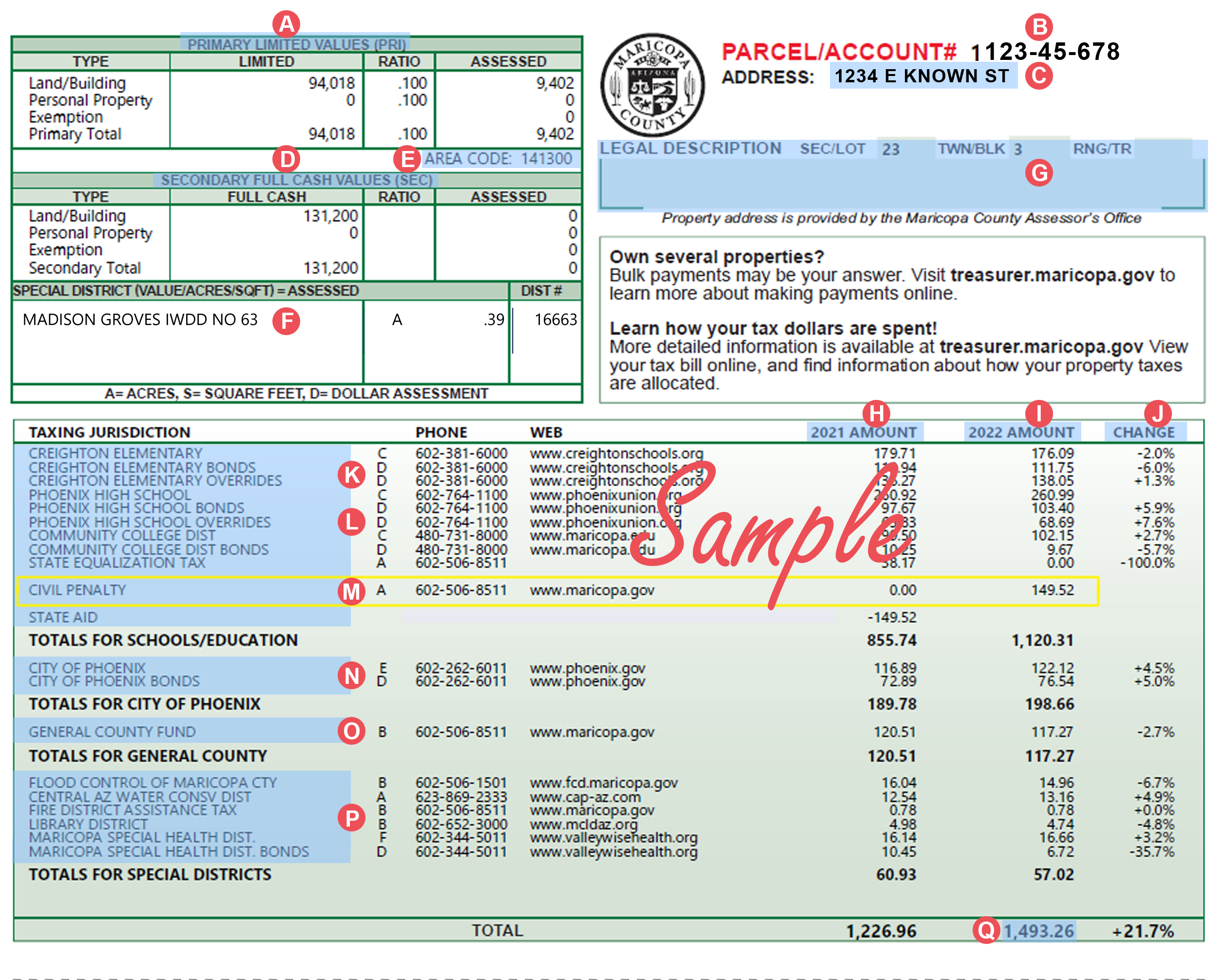

arizona real estate taxes

View the history of Land Parcel splits. Search the tax Codes and Rates for your area.

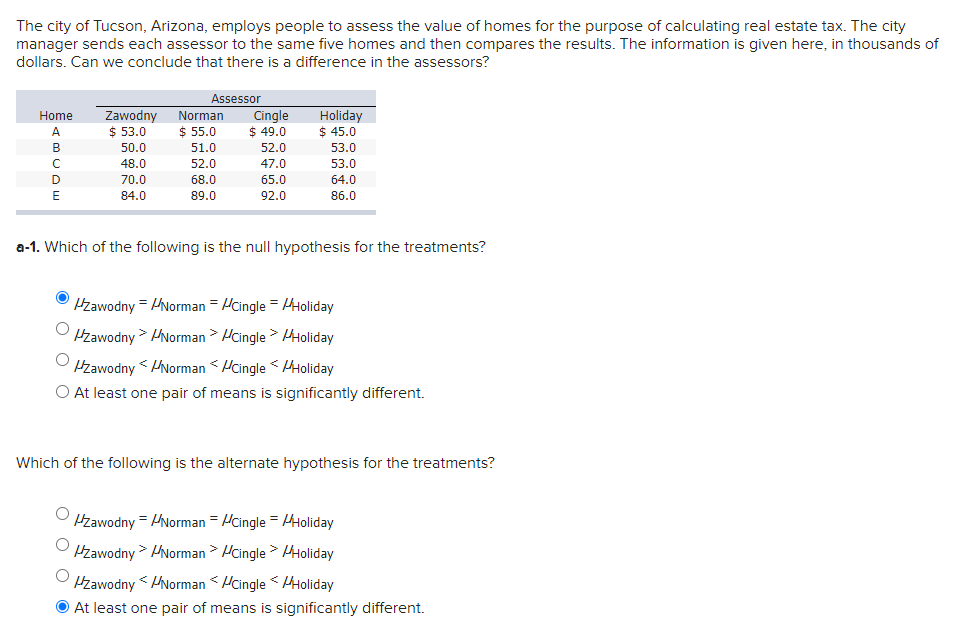

Solved The City Of Tucson Arizona Employs People To Assess Chegg Com

1 be equal and uniform 2 be based on present market value 3 have a single appraised value and 4 be deemed taxable unless specially exempted.

. Sources cited within the FAQs include the Arizona Constitution. Alternatively contact the Department Property Tax Unit at 602 716-6843 or ptcountyservicesazdorgov. Arizona Proposition 130 the Arizona Property Tax Exemptions Amendment is on the ballot in Arizona as a legislatively referred constitutional.

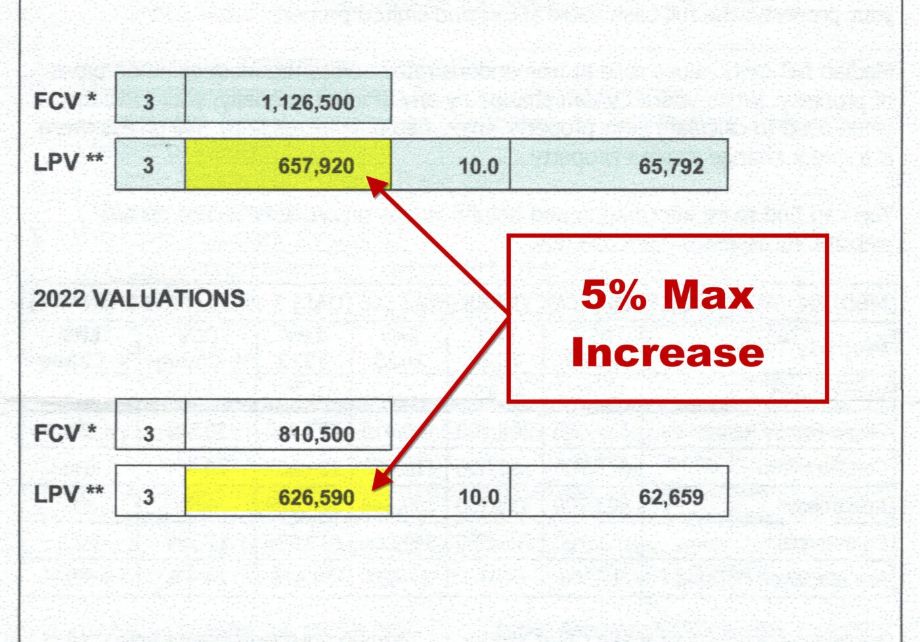

1600 West Monroe Street. For example in tax year 2016 Goodyears fiscal year 16-17 a Goodyear home had a LPV of 116424. 972022 Last day to pay to avoid Tax Sale.

AZTaxesgov allows electronic filing and payment of Transaction Privilege Tax TPT use taxes and withholding taxes. The LPV of 116424 would be multiplied by 10 to. Arizona veterans with disabilities have not been eligible for property tax exemptions for more than three decades.

The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homes. The State of Arizonas individual income tax filing season has launched and is now accepting electronically filed 2021 income tax returns. The effective real estate tax rate across the.

An amount determined by the Assessors office and is used in the calculation of the tax bill of a. The median value of a home in Arizona in 2019 is 193200. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer.

672022 2nd Installment Due. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Property taxes in Arizona are paid in two semi-annual.

1st Installment Due. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the. Second half taxes are due Wednesday March 1 2023 and delinquent after Monday May 1 2023.

View all options for payment of property taxes. Arizona Department of Revenue. The total amount that will be billed in property taxes.

The average effective tax rate in the. Interest on delinquent property tax is set by Arizona law at 16 percent simple and accrues on. Counties in Arizona collect an average of 072 of a propertys assesed fair.

The typical Arizona homeowner pays just 1578 in property taxes annually saving them 1000 in comparison to the national average. Taxation of real property must. A proposal on Novembers ballot could change that.

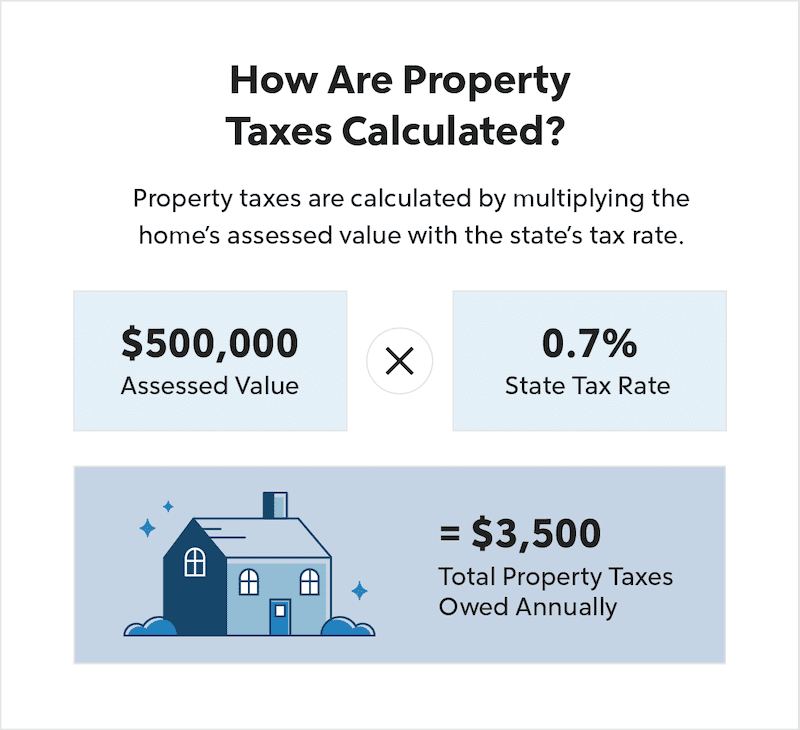

By the end of September 2022 Pima County will mail approximately 455000 property tax bills for the various property taxing jurisdictions within the County. To calculate property taxes paid. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

We created this site to help you to. The amount that you pay in property taxes is proportional to the value of your house. Before filing ensure you have all documentation.

Spring Property Tax Deadline This Week Wslm Radio

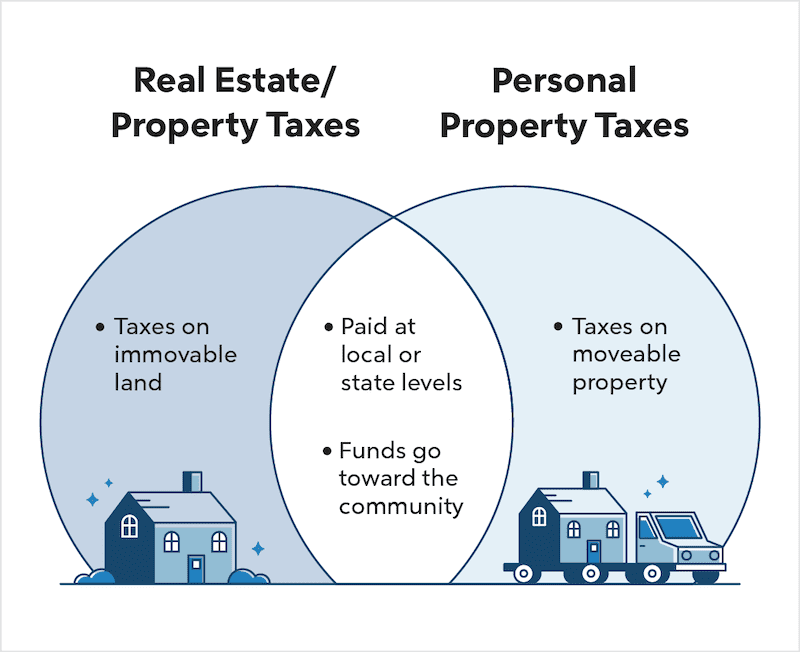

Real Estate Taxes Vs Property Taxes Quicken Loans

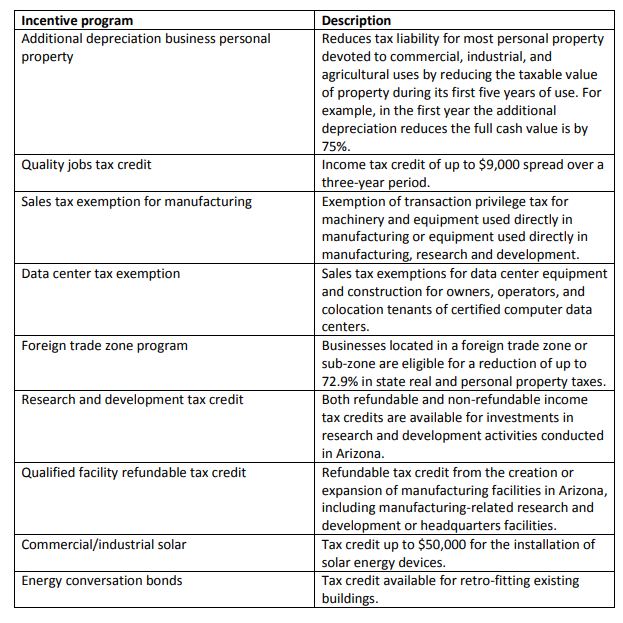

State And Local Taxes In Arizona Lexology

Where Do Arizona Residents Receive Most Value For Property Taxes Prescott Enews

Pay Property Taxes Online County Of Mohave Papergov

Property Tax Increases For Arizona Homeowners Arizona School Of Real Estate And Business

Property Taxes In Arizona The Basic Things You Need To Know Landmark Title Assurance Agency

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Real Estate Taxes Vs Property Taxes Quicken Loans

The Lowest Property Taxes In Arizona Savingadvice Com Blog

Initiative Drive Would Exempt Arizona Seniors From Property Taxes On Homes

Property Taxes By State How High Are Property Taxes In Your State

Will Maricopa County Supervisors Vote To Raise Business Property Tax Rates Nfib

When Should You Appeal Your Arizona Property Taxes

How Do State And Local Property Taxes Work Tax Policy Center